Wealthtech: Wealth Management for the Next Generation

An unprecedented generational wealth transfer is now underway. In the US alone, Millennials are expected to inherit $30 trillion from their Baby Boomer parents over the coming decades—money that many of them will likely manage differently, as they bring new values, anxieties, and expectations of digital, convenient, and personalized service to the process of growing their wealth.

These shifting dollars and priorities are creating a host of new opportunities for wealth management incumbents like Citi, which has spent much of the past two years integrating our wealth-focused business units into one $7.5 billion Global Wealth (CGW) organization. Serving over 500,000 clients with more than $800 billion in assets, CGW is already one of the world’s top wealth management institutions and is working to bring our entire global network together to deliver best-in-class service to the next generation of wealth clients.

As that next generation comes into its own, wealthtech will likely play an increasing role in how it manages its money. This growing ecosystem of digital investing and wealth-management solutions has been experiencing a renaissance of interest and investment recently: within a global wealth management market that is projected to reach $3.43 trillion in revenues by 2030, the wealthtech solutions market is expected to expand from $18.8 billion in 2021 to $42 billion in 2028 in North America, according to Insight Partners.

Over the past few years, Citi Ventures and our partners across the bank have been investing in and partnering with numerous wealthtech startups around the world. Through this work we have derived several themes within the space, which we will dive into over the course of a few articles—starting with those most driven by the transfer of wealth to new generations.

Wealthtech’s Demographics- and Disruption-Driven Growth

Uniting modern technologies with traditional wealth advisory services, wealthtech firms provide their customers with novel solutions in the familiar areas of banking, borrowing, investing, and financial planning.

For example, “robo-advisors” such as Betterment (a Citi Ventures portfolio company) use machine learning to offer automated investment advice, while micro-investment platforms including Acorns help users invest small amounts of money into ETFs. Digital brokerages like Robinhood offer commission-free active trading models and intuitive user experiences—revolutionizing retail investing for younger generations and leading incumbents like Charles Schwab to follow suit—while more holistic wealthtech platforms like new Citi Ventures portfolio company Warren combine multiple offerings in slick solutions tailored to particular markets (in this case, Brazil). As a whole, wealthtech solutions seek to lower costs for customers and make sophisticated investing and planning features more widely available—a particularly compelling value proposition amid a global pandemic.

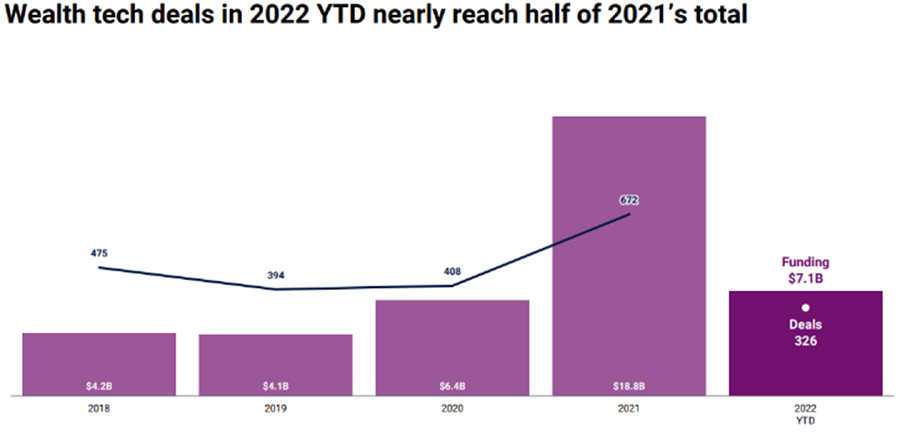

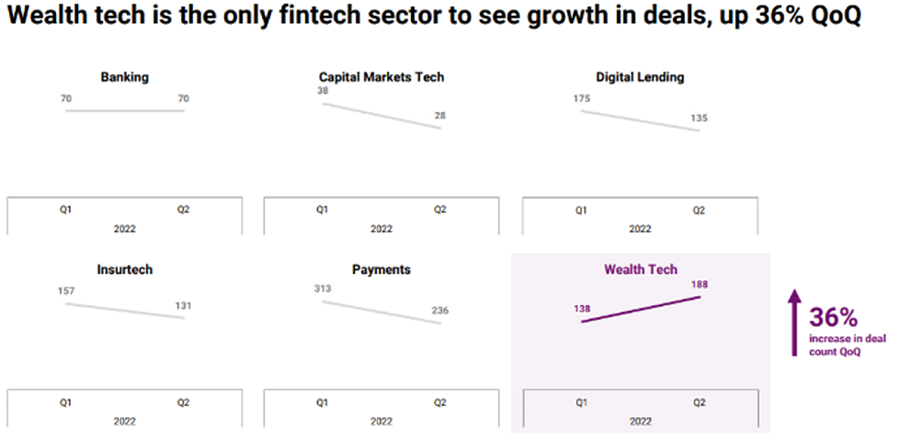

With the interest and hype around wealthtech accelerating quickly, the sector is now surging after years of moderate growth. CB Insights reports that wealthtech startup funding and deal volume shot up in 2021, reaching $17.5B (up 178% YoY) and 636 (up 67% YoY), respectively. Even amid 2022’s financial headwinds, the sector is proving resilient: it reached $7.1B in funding and 326 in deal volume in 1H 2022, and grew as a percentage of total fintech funding from 8% in 2019 to 14%. 1H 2022 also saw 47 wealthtech M&A deals, and in Q2 2022 the sector enjoyed its sixth consecutive quarter of nine or more “mega-round” ($100MM+) raises—helping make it the only area of fintech that grew in deal volume that quarter.

Source: CB Insights

Changing the Wealth Management Game

As the generational wealth transfer picks up steam—by 2030, all 73MM American Baby Boomers will be at least 65 years old—firms that fail to adjust their “one-size-fits-all” marketing and product strategies to the needs and wants of younger generations may find themselves falling behind.

A recent report by Accenture illustrates this clearly: surveying 1,000 investors in North America who have a financial advisor, the report found that 58% of them expect to inherit significant wealth from their parents and 28% plan to select a new financial advisor. It also found that Gen Xers, Millennials, and Gen Zers are far more likely than Boomers to trust algorithmically-generated financial advice, and are more than twice as likely to be interested in ESG or socially responsible investments.

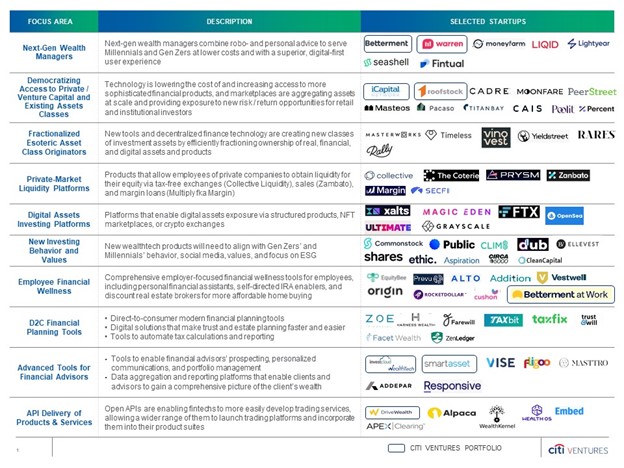

Into this evolving set of desires, values, and expectations steps a vast array of wealthtech solutions, which are innovating on numerous fronts in order to better serve wealth clients and financial advisors. These innovations include:

- Democratizing access to alternative asset classes – Alternative assets such as private equity and hedge funds have traditionally been inaccessible for all but the wealthiest individuals. Several wealthtech firms are working to change that, including two Citi Ventures portfolio companies: iCapital Network makes high-quality alternative investment funds available to individuals through their financial advisors, while Roofstock offers a nearly frictionless online marketplace for retail investment in the $3 trillion single-family rental home sector.

- Creating new asset classes and fractional ownership – New technologies are giving rise to new classes of investable assets by efficiently fractionalizing ownership of real, financial, and digital assets and products. For example, Pacaso buys single-family luxury homes and sells shares in them to groups of buyers. Additionally, Masterworks allows individual investors to buy small stakes in paintings by world-famous artists, and Rally offers a platform for buying and selling equity shares in nontraditional assets such as collectibles, classic automobiles, bottles of wine, and rare trading cards.

- Aligning with investor values and behaviors – Many wealthtech products and services cater to younger customers’ social media savvy and desire to invest in companies that match their values. On the values-based investing side, asset manager Ethic creates Separately Managed Accounts (SMAs) to invest in social responsibility themes, while neobank Aspiration offers a suite of environmentally-friendly banking services, credit cards, and investment products. On the behavioral side, new “social wealthtech” products like Commonstock are tapping into the eagerness of younger investors to discuss money online. A16z expects that other products marrying community-driven Internet culture with gamified, multiplayer approaches to collective investment will soon emerge, enabling participants to collectively direct their money to a greater goal—and to have fun doing so.

Source: Citi Ventures

WealthTechs and Financial Incumbents

As evidenced by JPMorgan’s 2020 acquisition of wealthtech startup 55ip, Franklin Templeton’s recent investment in crypto SMA platform Eaglebrook Advisors, and many other examples, incumbent firms across the financial services landscape are partnering with wealthtech players. These companies can bolster incumbents’ technical capabilities and expertise, enabling them to offer new products and reach new customers and clients in new regions and market segments.

As Citi begins to implement its integrated Wealth growth strategy across key markets worldwide, we at Citi Ventures believe that investing in and partnering with wealthtech startups can play a critical role in helping the bank achieve its goals. If you are a wealthtech player and would like to connect with us, please reach out via the email addresses below.

Stay tuned for more in the coming months.

To learn more, email Luis Valdich at luis.valdich@citi.com, Jelena Zec at jelena.zec@citi.com, or Thompson Barro at thompson.barro@citi.com.