The Rebundling of the Bank

A number of driving forces, e.g. the increase in financial products available to consumers, the growing number of API integrations across the financial ecosystem, and the rising collaboration between incumbents and startups, are all converging to create integrated financial management products. These products provide customers with a unified view or “single pane of glass” into their financial life.

This trend gives incumbents and FinTech startups alike the opportunity to assemble an end-to-end stack of the best-of-breed financial services under a single experience. These holistic financial management interfaces are breaking down silos, and helping customers allocate capital across all their financial needs to optimize their various goals. In the near future, I believe we can expect to see machines with access to all of a consumer’s financial data automatically manage money in ways that are much more efficient and effective than today.

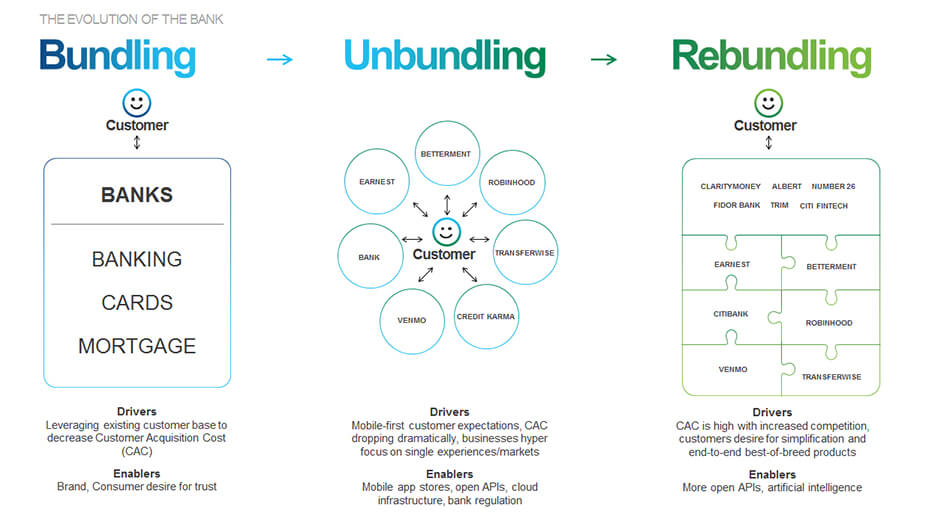

Banks have long recognized the value of bundling in driving operational efficiencies and providing relevant products to improve customer loyalty. In the past, companies strived to serve the financial needs of a consumer across insurance, lending, wealth management, banking, cards, and mortgage. However it proved difficult for a single entity to provide all relevant financial products across every asset class, personalized to each customer.

The Disruption - Unbundling of the Bank: Focusing on Consumer Choice

Today, FinTech startups specialize in specific offerings, building products that target specific demographics and use cases. By focusing their product offering, FinTech companies are able to create best-in-class products and user experiences for their target market - e.g., mobile savings for Millennials.

In 2015, Tom Loverro first visualized how startups had begun to disrupt different components of a bank. Since then, the number of companies in each vertical has grown dramatically. Two years later, CB Insights shared an updated visualization of this trend in their post “Unbundling of a Bank,” demonstrating how much FinTech has proliferated in the past few years.

Today, Tracxn tracks 16,475 startups in FinTech and a growing number of financial institutions have dedicated fintech initiatives.

The Evolution - Re-bundling of the Bank: Single Pane of Glass

The challenge with so many new financial products is that it becomes increasingly difficult for consumers to manage their disparate accounts, and to optimize between them effectively. If a platform could integrate these capabilities, then it would be possible to create a truly comprehensive financial services solution that is individualized for every consumer.

At the center of the thesis for re-bundling the bank is the ability to give customers a central hub that enables them to analyze their assets, and more importantly, to transact. This is the equivalent of the single pane of glass from the world of data centers, which integrates information from multiple applications into a unified view. Through this hub, customers can get a comprehensive view of their historical, current, and future financial situations. Thanks to this consolidated data, these platforms are able to give customers financial management capabilities across multiple financial products and financial institutions. Customers receive solutions personalized to their needs with the ease of managing disparate solutions consolidated under a single brand. With this evolution, users get real-time visualizations via a centralized dashboard that allows them to control all aspects of their financial lives and create simulations of their future.

Some neo-banks are taking the next step to build a platform for other startups to plug into – for example, Simple, Fidor, Number26, Atom Bank, and others enable external financial services as options for customers on their platform. For example, Transferwise’s P2P international money transfers will now be available on the Number26 banking platform via its API. However, these entities often do not have visibility into what happens on the 3rd party platforms that connect to them if customers leave their application.

What's Next

At the end of the day, most individuals do not think about their financial lives in silos. When people receive a paycheck, they rarely optimize it to determine where it ought to be distributed: e.g. allocating $150 for brokerage, $400 for robo-advising, $500 for paying down debt, $200 for a checking account. For most consumers, the process is basic: there are inflows (income) and outflows (expenses), there are needs for today, and goals for the future.

Machines and artificial intelligence can play a huge role in automating and optimizing decision-making, e.g. by combining historical information, market data, and simulations of the future to recommend the optimal allocation of customer funds.

Moreover, a machine could identify trends in behavior and make recommendations for individuals in a safe and secure manner. For example, machines would be able to identify that “people like you” who live in a region with a particular vehicle pay less in car insurance, and provide the ability to change providers. It would be able to identify that customers can save an additional $2,500 because of rolling credit card debt that could be refinanced into an installment loan by another provider. It could identify that the FX provider a customer uses is charging significantly more than others and automatically switch. If connected to other parts of a customer’s life, it could identify that a customer has not used his Hulu account in 3 years, but pays $11.99 every month for that account, and prompt the customer to cancel it.

For customers that want a low-touch financial solution, bots can give them the confidence that their capital is being optimized on their behalf without requiring an extensive lift. For self-directed customers, this model provides an integrated platform to execute across their financial products. For customers that prefer to be highly informed, it gives them a single interface for monitoring how their assets and liabilities are performing across services.

The exciting part is not only a centralized view into a customer’s financial life, but ultimately the integrations and ability to execute on recommendations provided by the platform (or provide customers with single click execution). Lead generation with little relevance to the individual consumer becomes a thing of the past, and can be replaced with full loan applications. We’re already seeing companies such as Albert, Clarity Money, Trim begin to build the foundations of these products, and will be watching how this space evolves.