New “GenAI fintechs” are driving AI further into financial services — here’s how

The past year has witnessed an unprecedented surge of enthusiasm around generative AI (GenAI)’s transformative potential across industries. GenAI startups raised $25.2 billion in 2023 and $18.8 billion in the first five months of 2024 alone, signalling strong confidence across the venture capital ecosystem in the technology's future.

Within financial services specifically, GenAI applications are swiftly gaining ground: per NVIDIA, 43% of finance professionals are already using GenAI and 55% more are considering using it. The industry’s stringent regulations, complex operations and vast troves of data make it an ideal arena for GenAI-driven innovation — innovation that a recent Citi Global Perspectives & Solutions report estimates could increase the global banking sector’s profit pool by $170 billion (approximately 9%) by the end of 2028.

These same factors present significant barriers to the adoption of GenAI for financial services-focused workflows, however (as opposed to adoption for horizontal cross-industry use cases such as report generation, marketing and customer engagement). This unique blend of challenges and opportunities has prompted a wave of fintech startups to develop GenAI-based solutions designed to tackle the finance industry’s specific needs.

While these “GenAI fintechs” may need to find ways to outmaneuver their incumbent competitors, we believe that there are several areas where they can win — and are already beginning to establish themselves. Read on for our thoughts on the most promising use cases for GenAI in financial services, drawn from our database of over 200 GenAI fintechs (and counting).

GenAI Applications for Financial Services

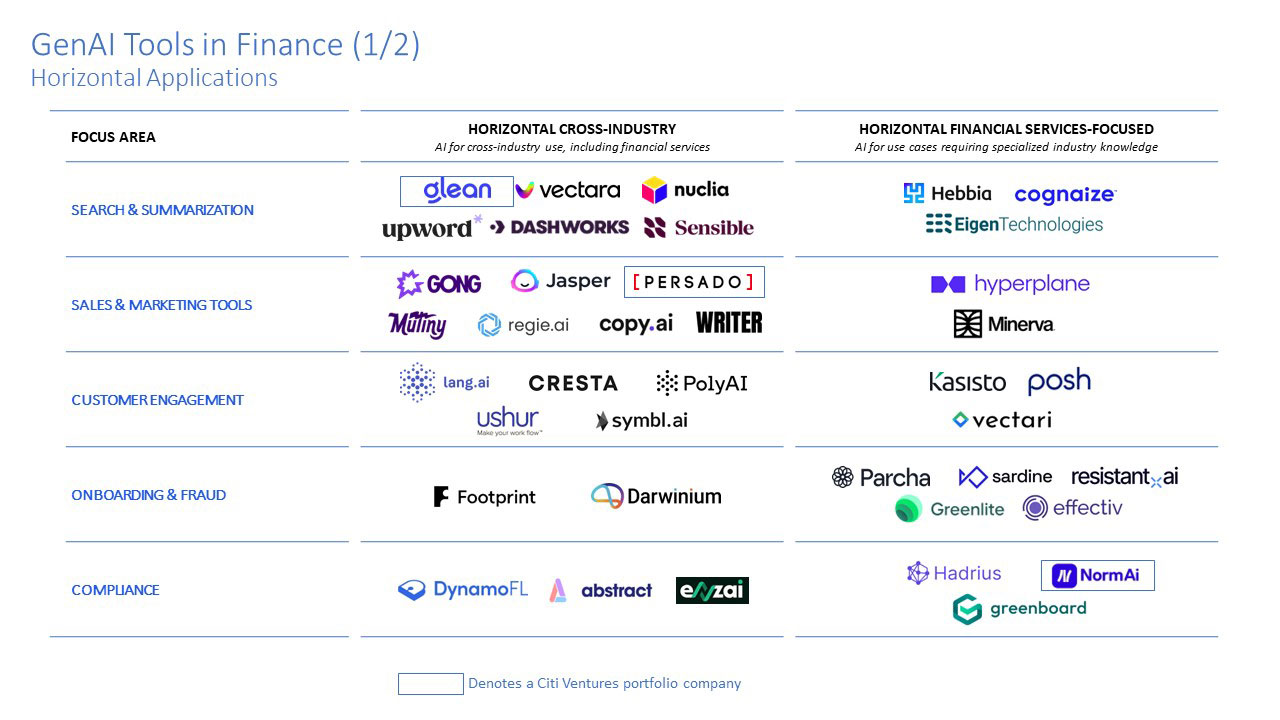

In our research, we have identified three categories of GenAI use cases relevant to financial services:

(1) Horizontal cross-industry

(2) Horizontal financial services-focused

(3) Vertical financial services-specific

As mentioned above, horizontal cross-industry use cases apply to various industries and can be served by general-purpose AI tools like those our portfolio company Glean provides. Horizontal financial services-focused use cases require specialized knowledge of the industry; e.g., our portfolio company Norm Ai is using GenAI to help financial services firms track and comply with the sector’s unique rules and regulations. Lastly, vertical financial services-specific use cases pertain only to financial products and associated workflows.

Within the financial services-oriented use cases, we believe that GenAI fintechs can challenge incumbents by optimizing their solutions for key characteristics of their particular use case, such as deep workflow integration and access to proprietary data. Several startups are in fact already doing so for use cases such as:

Horizontal financial services-focused:

- Compliance, Onboarding and Fraud

GenAI is well-positioned to improve efficiency, accuracy and speed in these areas. Examples include:

- Norm Ai, whose Regulatory AI Agents can evaluate whether proposed content or actions are compliant with relevant regulations;

- Effectiv, which leverages AI during new user onboarding to analyze documents, identify fraud risks and generate reports for compliance reviews;

- Sardine provides comprehensive, AI-powered fraud prevention solutions for transaction monitoring, AML, customer onboarding and identity checking;

- Hebbia's AI-powered tools help streamline regulatory compliance by automatically extracting critical information from documents and rapidly identifying potential risks and issues in large datasets.

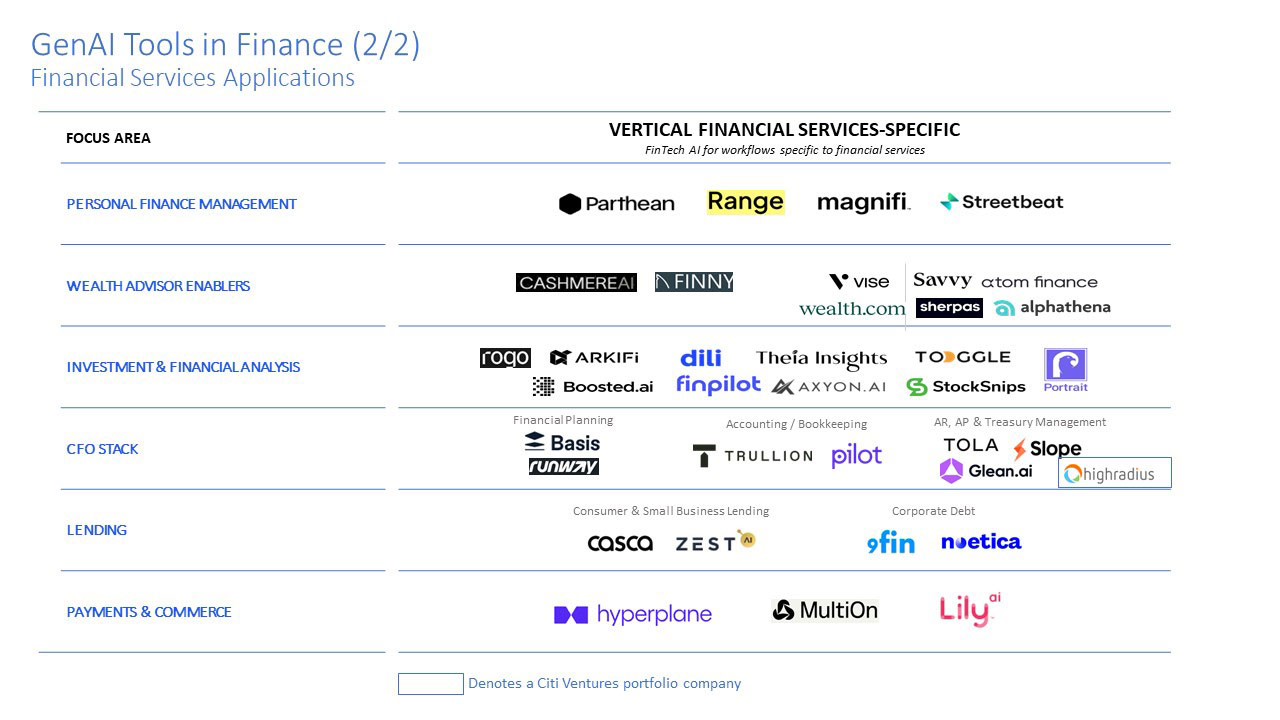

Vertical financial services-specific:

- Personal Finance Management

GenAI has the potential to help realize the long-awaited dream of “self-driving money.” For example:

- Range, a consumer-focused wealth management platform, leverages AI-powered insights to provide personalized financial plans and recommendations.

- Streetbeat allows users to talk to an AI-powered advisor, ask about the market and create their own investment portfolio.

- AI-driven financial coach Parthean helps users optimize their spending, investing, credit, savings and more.

- Wealth Advisor Enablers

GenAI is helping optimize wealth advisors’ workflows. For example:

- Cashmere AI uses GenAI to identify and engage high-potential prospects for wealth advisors, automating personalized outreach campaigns to drive new customer relationships.

- Sherpas, a platform that automates client engagement for wealth advisors, offers GenAI-powered data extraction, personalized diagnostics, investment proposals and tailored content generation to maintain client trust and satisfaction.

- Investment and Financial Analysis

GenAI can optimize workflows for investment professionals by automating analysis and enabling more efficient data access. For example:

- Arkifi automates tasks like building models and pulling comps, allowing users to conversationally query and analyze data from various sources.

- Boosted.ai helps investment managers research stocks, generate trade ideas, analyze portfolio risk and model scenarios to optimize their portfolios.

- Rogo searches, analyzes and cites millions of documents to produce actionable insights from financial data faster.

- Chief Financial Office (CFO) Stack

GenAI can improve how all businesses perform their internal financial activities by automating workflows and providing deeper insights. For example:

- HighRadius (a Citi Ventures portfolio company) has launched a GenAI-native solution to automate payments to suppliers;

- Financial planning tool Runway is building GenAI workflows for tasks such as budget creation and forecasting;

- Trullion, an accounting platform that simplifies revenue recognition, lease accounting and audit workflows, deploys GenAI to extract data from contracts, provide automated alerts and generate instant reports for Finance leadership;

- Payments and financing platform Slope uses GenAI to reconcile incoming payments with corresponding invoices.

- Lending

GenAI is helping streamline and democratize lending processes via automation. Examples include:

- Casca, an AI-powered loan origination system that automates customer engagement and provides intelligent workflows for loan officers;

- Noetica, which assists dealmakers in benchmarking corporate debt transactions by using AI to scan credit documents and compare them to thousands of similar deals.

- Zest AI, a lending platform that uses Gen AI in its credit underwriting software to help lenders make more accurate and fair lending decisions.

- Payments and Commerce

Finally, GenAI is opening up myriad new opportunities in the payments and commerce space. For example:

- Hyperplane enables banks to deliver hyper-personalized consumer experiences by leveraging transaction data to clean, enrich and extract consumer financial behavior.

- MultiOn enables developers to embed into their digital products AI agents that can complete tasks on users’ behalf. Its use cases span shopping and financial services.

The Road Ahead

For all their finance-optimized, AI-native capabilities, GenAI fintechs still face substantial hurdles as they seek to carve out space for themselves in a competitive market.

First and foremost, they are at risk of losing their domain-specific advantages to horizontal AI solutions, including large language models (LLMs) developed by major tech companies, which may replicate their specialized functionalities. Established fintechs and legacy software vendors are also increasingly integrating GenAI into their existing offerings, as we’ve seen from early movers like Klarna and Ramp.

Navigating the heavily regulated landscape of financial services adds another layer of complexity to this task. Financial institutions must rigorously test AI systems to address potential issues of bias, fairness and regulatory compliance; as a result, GenAI fintechs must meet stringent enterprise standards concerning data sovereignty, security and system robustness.

Therefore, we believe that the GenAI fintechs most likely to win will be those that can both successfully carve out a niche within financial workflows — by delivering an unparalleled user experience or building a data moat, for example — and win the trust of financial institutions by demonstrating that they can operate within regulatory mandates.

Moving forward, we also anticipate that significant opportunities will arise for GenAI fintechs that can best harness the technology’s forthcoming advancements. As LLMs grow more complex and capable of processing diverse data types such as images and audio, their ability to produce multimodal outputs should create new space in the market. So should the emergence of agentic workflows, which will empower AI agents to independently manage complete processes using advanced skills in reflection and planning. Startups that can navigate these technological shifts and effectively use GenAI to innovate will set the pace for the industry, driving growth and shaping the future of financial services.

For more information, email Jelena Zec at jelena.zec@citi.com or Luis Valdich at luis.valdich@citi.com.