Embedded Trade: An Emerging Growth Opportunity

From Amazon's one-click ordering to Uber Cash, we are seeing a trend of non-finance companies embedding financial services into business-to-consumer (B2C) commerce and making it a fundamental part of their tech stacks and business models. We are seeing a similar trend in business-to-business (B2B) commerce through the advent of Embedded Trade, or the integration of financial services into physical supply chain activities such as ordering and shipping goods.

In recent years, we have seen an evolution in digital freight models that has disrupted the global trade ecosystem and propelled the convergence of previously separate supply chain logistics and financial systems. This convergence promises significant opportunities for banks like Citi and other financial service providers to grow by embedding financial products into B2B trade and commerce.

Parallel Universes

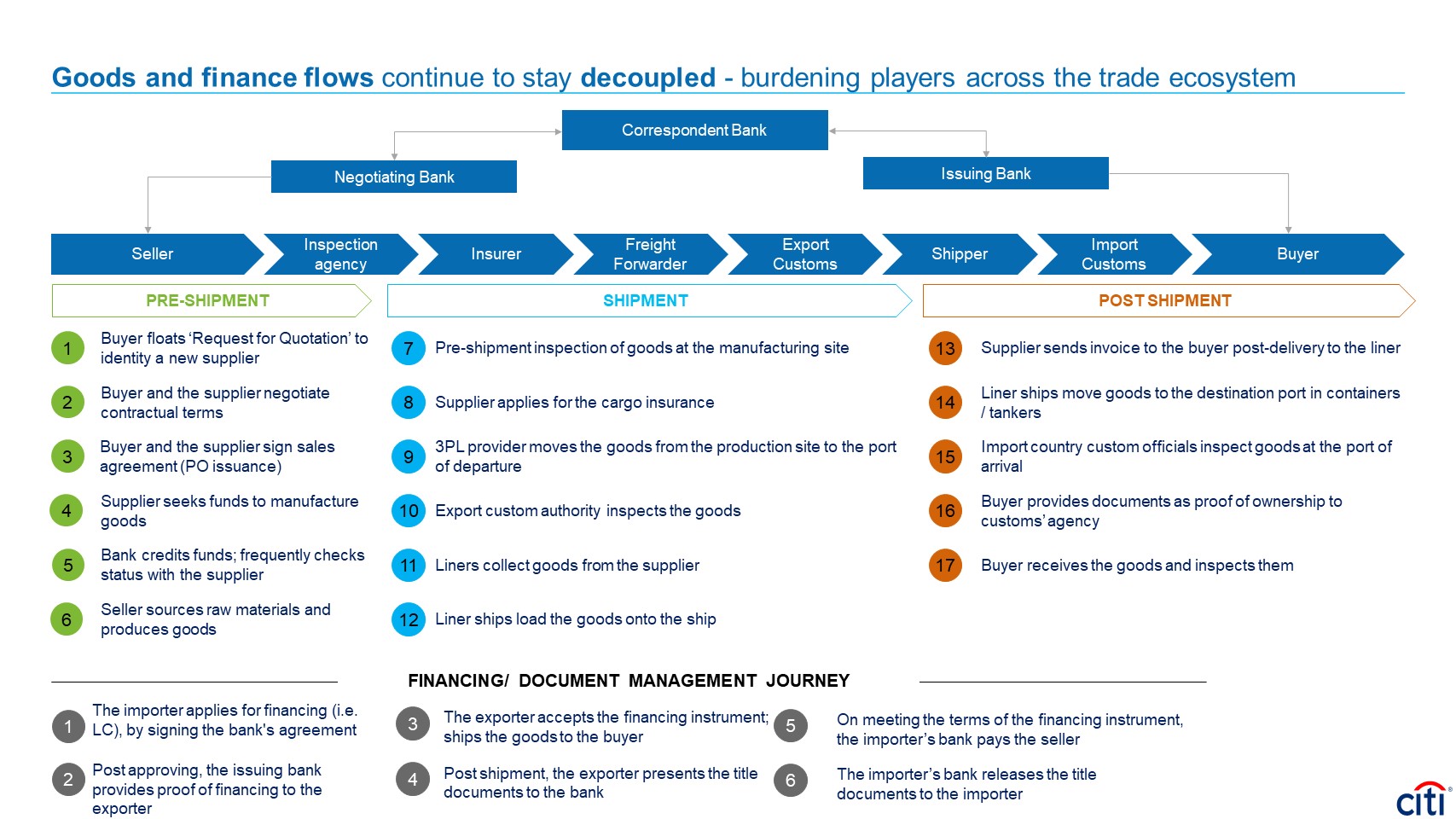

Within the global trade ecosystem, logistics and financing have traditionally operated in parallel universes, each consisting of a complex web of players using paperwork-intensive processes and outdated technology to facilitate each step in the supply chain.

For example, today’s ocean freight shipping involves a half-dozen or more contractors and subcontractors who each handle specific steps of the shipping journey—route planning, preparing trade documents, clearing customs, loading cargo onto ships, and trucking goods to their final destinations. Alongside these steps, importers and exporters typically undergo a separate, similarly complex process to secure trade financing.

This disconnect between physical and financial supply chains is one of the primary reasons for an estimated $1.5 trillion worldwide trade finance gap, which renders many small and medium-sized enterprises (SMEs) unable to access the traditional trade finance products offered by banks and other institutions. According to the World Economic Forum, inadequate trade finance is one of the top three export obstacles for half of the world's countries—particularly poorer nations—and constrains global growth and development.

There is room for improvement when it comes to the customer experience in the freight shipment process. Quoting and booking for a single shipment can require 100 hours of email interaction, and tracking shipments in real-time is difficult, time-consuming, and error-prone, with many steps relying on personal handoffs and even faxes.

Unlike tech startups born in the digital age, freight shipping lags behind other industries in technology adoption. This is changing with demand rapidly growing for digitization to improve transparency and visibility, shipping times, and customer experience. In a 2019 industry survey, 49% of respondents said they currently use a mix of digital solutions in their logistical processes, including online marketplaces and tracking tools. More than 30% said that such technology represents an important part of their overall strategy.

© 2020 Citigroup Inc.

Increasing Digitization

The demand for improvements coupled with technological advances has produced a wave of digital freight shipping disruptors that emphasize connectivity, visibility, and analytics to improve delivery speed, reduce costs, and enhance customer experience. As a result of customer frustration, for example, many digitally native freight logistic start-ups including Flexport, Forto (formerly FreightHub), and Transfix have emerged to address customer pain points and deliver a more intuitive shipping process.

Meanwhile, fintechs and logistic technology (logtech) startups have made inroads with more seamless digital versions of financial products and services previously offered solely by traditional financial institutions. These include supply chain financing, purchase order financing, and receivables factoring. U.K.-based Beacon serves as the booking agent between importers and exporters while facilitating door-to-door shipping and finance through a single platform. And Haven, a digital freight enabler, produces end-to-end Transport Management System (TMS) software provides freight rate discovery, booking, workflow coordination, documentation, and tracking and analytics services.

Faced with digital disruption, incumbent players in the trade ecosystem have focused on tying freight shipping decisions to the purchase of financial products through integrated quoting and invoicing products. Maersk, the world's largest container ship and vessel operator, has partnered with IBM to create TradeLens, a blockchain-based ecosystem of supply chain partners—including cargo owners, ocean and inland carriers, freight forwarders, logistics providers, ports and terminals, and customs authorities—that promises to quickly and reliably share documents and shipping data.

Meanwhile, disruptors have looked to fill the trade finance gap by leveraging the data they gather on shipments to offer more innovative financial products and induce non-traditional financiers to back the funding of shipments.

Growth Opportunity

A global trade ecosystem in which managing supply chain activities and purchasing financial products are merged into a single, automated process that emphasizes ease-of-use and a seamless user experience presents a growth opportunity for banks and other financial institution. Global banking institutions, like Citi, already play a critical role in facilitating global trade and support shippers, carriers, freight forwarders, brokers, and other key stakeholders.

Citi Ventures and Citi’s Treasury and Trade Solutions business are partnering to explore the concepts, companies, platforms, and players that best exemplify Embedded Trade opportunities.

We believe this is an emerging trend to watch and look forward to seeing continued innovation in this sector.