DAO-WN THE RABBIT HOLE: A PRIMER ON DECENTRALIZED AUTONOMOUS ORGANIZATIONS

If you have read anything about crypto over the past year, chances are you have come across the term “DAO,” or Decentralized Autonomous Organization. One example is ConstitutionDAO, which tried (but failed) to buy an original copy of the US Constitution in 2021. Wondering what DAOs are and why they are relevant for financial institutions like Citi? Then read on.

What is a DAO?

First envisioned by Vitalik Buterin, co-founder of the Ethereum blockchain, in 2013, DAOs have no exact definition but can be described as groups of people that organize themselves around a shared purpose through decentralized governance.

Let’s break that down:

- Decentralized: Governance of the organization is distributed across its members, and is run on open blockchain infrastructure

- Autonomous: DAOs are self-governing and can self-sustain without outside influence

- Organization: DAO members coordinate and collaborate around shared objectives

In a nutshell, DAOs are the equivalent of traditional companies in the web3 space: distributed communities of people that work together on a project or protocol geared toward a common goal.

Why Form a DAO?

Blockchain technology enables new forms of governance and social interaction that weren’t possible before, and DAOs leverage that technology to create more egalitarian, democratic organizational structures.

DAOs are open by design, allowing everyone involved to participate in the decision-making process. To join a DAO, all one has to do is obtain a digital asset called a “governance token,” which allow those who hold them to make and vote on proposals. Interested participants can thus contribute from anywhere in the world regardless of their backgrounds, making DAOs a highly inclusive medium for collaborative work.

DAOs are also both pseudo-anonymous and transparent, as they operate on public blockchains that conceal participants’ identities but make all of a DAO’s transactions, such as votes on proposals, visible to anyone in the world. Transparency is key to the success of a DAO, as it brings trust into the pseudo-anonymous relationship between participants and ensures that abuses and corner-table deals are avoided.

Operating on a public blockchain also provides DAO token-holders access to digital asset markets, enabling them to trade their governance tokens on decentralized exchanges. In some ways, DAO token-holders are like traditional stock owners, except that the “shares” they own (the tokens) are embedded via smart contracts with utility functions such as the aforementioned ability to create and vote on proposals. In fact, shares and governance tokens are so similar that the SEC is considering regulating them in the same way.

Lastly, the decentralized nature of DAOs makes them more resilient and resistant to censorship than centralized organizations often are. The power structure of a DAO is heterarchical: based on mechanisms of cooperation without subordination, unlike the hierarchical structure of traditional corporates. Some people hail the emergence of DAOs as the next iteration of the firm—an organization that does not have to focus on generating cash each quarter or returning value to its shareholders, and therefore can keep its attention on the product itself.

Source: Aragon

How to Operate a DAO

But how do you actually run a DAO? There are no predefined rules, as DAOs exist along a spectrum of decentralization and autonomy: some are highly decentralized, while others have concentrated power. The ideal governance structure for a DAO thus depends on several factors, such as the purpose, complexity, and stage of the underlying project.

Decision-making in a DAO is usually done through voting. The most common model is token-weighted voting, where the degree of influence depends on the number of governance tokens someone holds. Examples of other designs are quadratic voting and time-weighted voting.

There are also many tools available that can help DAOs operate, including:

- DAO Frameworks: Tools to deploy DAOs

Examples: Orca, Aragon - Governance Tools: Tools that enable voting

Examples: Tally, Snapshot, Boardroom - Treasury Management Tools: Tools that manage the DAO’s funds

Examples: Gnosis, Llama - Payment and Compensation Tools: Tools that process transactions

Examples: Utopia

Most DAOs start as crypto projects centralized around the core team that develops the protocol. Once the project achieves product-market fit and sufficient community participation, the core team can then begin to decentralize control in a process called “progressive decentralization.” For example, MakerDAO—the world’s first decentralized finance (DeFi) protocol—was initially run and controlled by the traditionally structured MakerDAO Foundation, but it announced last year that it would dissolve the Foundation and hand over control to the DAO itself, thereby achieving full decentralization.

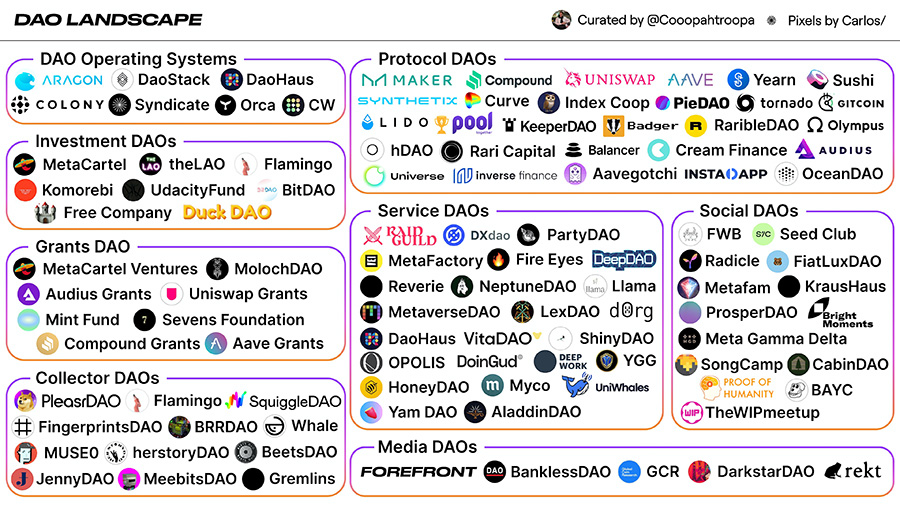

The DAO Landscape

Since the launch of the first DAO in 2016—“The DAO,” which infamously suffered from a hack worth 3.6MM Ether ($60MM at the time)—the ecosystem has grown and evolved significantly. There are now over 4,800 DAOs in existence, which span numerous use cases and sectors. DAOs have also expanded greatly in terms of treasury: in 2021 alone, the collective value held by DAOs grew by around 40X to over $10B.

DAOs come in many forms and can be categorized in many different ways. One approach is to group them as follows:

- Protocol DAOs: DAOs used to govern decentralized protocols such as financial applications.

Examples: Aave, MakerDAO, Lido - Infrastructure DAOs: DAOs that provide tools and infrastructure for other DAOs, such as tools for governance, treasury asset management, and discussion.

Examples: Tally, Snapshot, Gnosis - Service DAOs: DAOs that coordinate labor or other services for other DAOs.

Examples: Raid Guild, YGG - Social DAOs: Communities centered around similar interests or goals. In several cases, a token or invitation is needed to get access.

Examples: Friends With Benefits, Bored Ape Yacht Club - Investment DAOs: DAOs that pool capital of members to invest in projects and assets.

Examples: BitDAO, theLAO - Collector DAOs: DAOs that curate and collect assets such as NFTs.

Examples: FlamingoDAO, ConstitutionDAO - Media DAOs: DAOs that produce community-driven content.

Examples: BanklessDAO, rekt - Grant DAOs: DAOs that give grants or donations to projects and causes that align with their mission.

Examples: Aave Grants

Source: Coopahtroopa

Challenges to DAO Adoption

While DAOs have sparked a lot of experimentation with governance structures, they face similar challenges to those that other corporates and societies have experienced throughout history—including voter apathy (today, under 10% of DAO token-holders vote), centralization concerns, DAO delegates, and hacks. Examples such as that of the Build Finance DAO, in which a single user was able to hoard enough governance tokens to take full control of the DAO’s governance contract, minting keys, and treasury, demonstrate that DAOs are no silver bullet for bad human behavior and politics.

Moreover, the ethos of decentralization can stand in direct conflict with running an organization efficiently. In order to mitigate problems of low voter participation and limited access to important information, some in the DAO community propose to move from direct democracy to representative democracy and include oversight committees. Others, including Vitalik Buterin, suggest that voting via tokens isn't the way to go at all. Emerging designs such as SubDAOs or Pods—subsets of DAO members that have specific functions such as Operations and Treasury—could also help improve the efficiency of operating a DAO.

Another key challenge for DAOs is that they often lack focus and drive. In the case of ambitious, large-scale projects in particular, decentralizing the entire decision-making process can lead to uncertainty, design flaws, and ultimately chaos. As such, hybrid processes can be a good compromise, leaving some decisions to the community and centralizing some aspects of the strategic roadmap. As the DAO grows and matures, more aspects of the governance can gradually be delegated to the community through progressive decentralization.

Finally, as noted above DAOs have started to attract scrutiny from regulators. The Commodity Futures Trading Commission (CFTC) recently sued a DAO called Ooki DAO—as well as its governance token-holders—for disobeying anti-money laundering laws and unlawfully engaging in activities that required registration through existing commodities laws. “DAOs are not immune from enforcement and my not violate the law with impunity,” the CFTC concluded.

Financing a People-Powered Future of Work

The emergence of blockchain technology and digital assets is unlocking new ways for organizations to coordinate. While DAOs are still in their infancy and we expect continued experimentation in the coming years, their potential to redefine how people work and collaborate is clear and should lead to further growth in this ecosystem. We look forward to seeing where the space goes next.

For more information, email Steven Biekens at steven.biekens@citi.com or Julien Donnet at julien.donnet@citi.com.