How AI is transforming wealth management

Key takeaways

- Artificial intelligence is penetrating nearly every facet of wealth management, from consumer-facing products and services to automated tools for wealth advisors.

- Though it faces substantial technological and regulatory barriers to broad adoption, AI has the potential to revolutionize the industry and help it meet next-generation investors where they are.

- As Citi implements its wealth strategy and seeks to capitalize on generative AI, Citi Ventures is looking to invest in the AI-driven wealthtech startups of the future.

The AI revolution has officially arrived. As generative AI has exploded onto the scene, 47% of companies surveyed by CNBC now say that AI is their top priority for tech spending over the next year.

Meanwhile, wealth management — traditionally a sector driven by personal relationships and human touch — is undergoing a seismic shift thanks to the advent of wealthtech apps. The AI-driven digital transformation of wealth management is challenging the status quo, augmenting the traditional model with advanced, intelligent systems.

At Citi Ventures, we believe that AI has the potential to transform the sector entirely, making wealth management more accurate, personalized, efficient and democratized. But where is it being used to truly advance innovation rather than as a mere marketing buzzword?

Read on for our insights into the opportunities and challenges facing the use of AI in wealth management.

Where AI is impacting wealth management

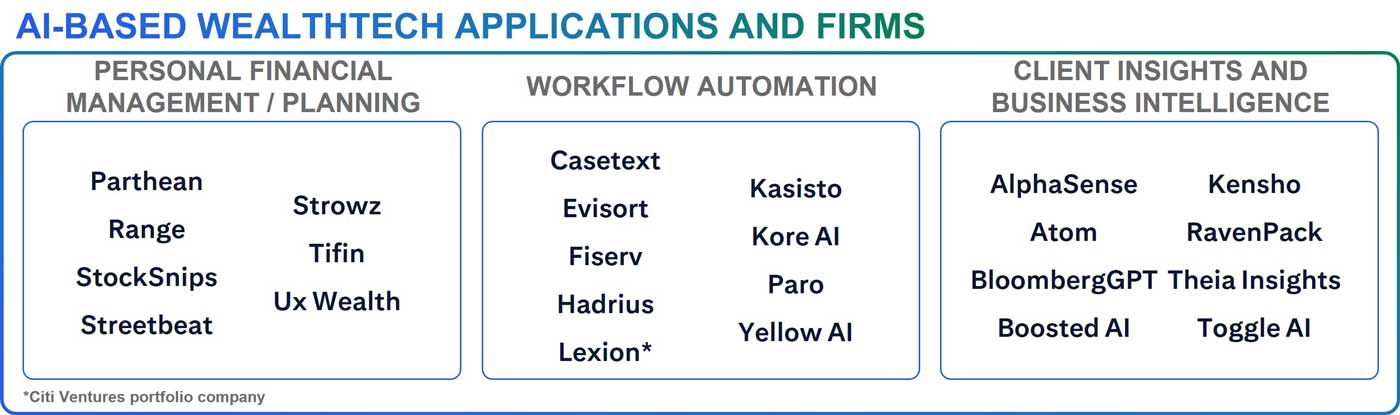

Executives across financial services are excited to understand generative AI and its applicable use cases. Within wealth management, those use cases fall into three broad categories:

- Democratization: Perhaps the most profound impact of AI is the democratization of wealth management, which has historically been an exclusive service accessible primarily to high-net-worth (HNW) individuals. AI has helped break down these barriers in such areas as:

- Personal finance / Financial wellness: Wealth clients expect services tailored to their unique financial goals, risk appetites and investment preferences. One reason this level of personalization was typically reserved for HNW individuals was due to the time and resources required to manage such custom portfolios. AI is helping bring these services to the broader wealth market via automated digital solutions, including assistants that help users optimize their personal finances (including tax planning, portfolio analysis and investment management) and financial coaching apps that teach consumers how to invest.

- Investing and trading: Many modern wealthtech platforms employ AI capabilities such as deep learning and large language models (LLMs) to construct portfolios, provide investment advice and trade stocks on behalf of their users.

- Workflow automation: AI's automation capabilities can significantly improve operational efficiency in wealth management. Tasks such as portfolio rebalancing, regulatory compliance and reporting can be automated — further democratizing access through cost-effectiveness, reducing human errors and freeing up time for wealth managers to focus on their customers.

AI-based workflow automation solutions include:

- Workflow optimizers and administrative capabilities: These solutions use LLMs and natural language processing (NLP) to automate and streamline critical operations such as bundling third-party services and processing administrative documents, saving significant time and resources. For example, they can facilitate the creation of financial plans or quarterly performance reports — traditionally a long and manual workflow — by ingesting client documents and populating templates with the information they have collected for advisors to review.

- Customer relationship management tools: Layering generative AI on top of existing automated customer service tools can yield smarter, more personalized responses that are both more helpful to the client and much less time-consuming for the advisor. These range from chatbots that can emulate bankers and provide customers with quick responses to basic queries, to “intelligent digital banking assistants” that serve as on-demand virtual bankers available 24/7.

- Client insights and business intelligence: Deeper business intelligence and greater understanding of client portfolios can improve an investment advisor’s ability to provide superior service to their clients, giving them a competitive edge over their competitors.

New solutions are emerging that use generative AI to discern patterns in immense amounts of unstructured financial data and quickly distill insights that they can communicate to advisors using NLP/LLM-powered chatbots.

Source: Citi Ventures

Challenges to growth

Despite its substantial upside, the broad adoption of AI in wealth management still faces major hurdles and lingering questions around such topics as:

Regulatory compliance

As evidenced by U.S. Senator Chuck Schumer’s SAFE Innovation Framework and calls from AI leaders themselves for policy-makers to regulate the technology, the question of where and how to put guardrails on AI is a thorny one. This is due in part to the opaque nature of AI models, many of which have grown so large and complex that even AI engineers don’t know exactly how or why they work. Amid this uncertainty, many wealth incumbents would rather wait and see than jump into adopting AI and risk incurring large fines and reputational damage through non-compliance.

Model output reliability

Given the above “black box problem,” solutions that leverage modern AI models run the risk of presenting users with incorrect or misleading outputs. An AI model’s accuracy is directly tied to the amount and quality of the data it is trained on — thus, if one is trained on inaccurate, incomplete, skewed, corrupt or insufficient data, its insights will be unreliable. LLM-based chatbots in particular (e.g., ChatGPT) often give users different answers to the same question asked with different phrasing, or even confidently provide incorrect answers to questions about topics they haven’t been trained on (a phenomenon known as “hallucination”).

These problems can have massive consequences in the context of wealth management, as unreliable insights limit the user’s ability to predict trends and make effective decisions.

Bias and fairness

AI systems learn from the data they’re fed. If the underlying data contains biases, the AI system can also become biased, leading to unfair outcomes. For example, an AI system trained on data primarily from HNW individuals might not perform as well when advising a lower-income client. Ensuring fairness in AI systems is thus both an ethical and a business necessity, and requires careful attention to the data used for training the models.

AI autonomy

While AI can automate many aspects of wealth management, completely eliminating human control can pose ethical issues. How much decision-making autonomy should AI systems have when dealing with someone's life savings? Striking the right balance between AI autonomy and human control is crucial to maintaining trust and safety.

Responsibility and accountability

When AI systems do make decisions themselves, it can be challenging to assign responsibility if something goes wrong (e.g., a risky investment that leads to a significant loss). Who is accountable in such scenarios: the AI developers, the wealth management firm or the end-user? In order for AI adoption in wealth management to truly scale, clear guidelines for responsibility and accountability must be established.

Investing in the AI-driven future of wealth management

From personalized advisory and improved risk management to democratization and streamlined operations, AI is making wealth management more precise, accessible and efficient than ever before. While much in the space remains to be determined, it is clear that AI in wealth is here to stay.

With both wealth management and generative AI central to Citi’s long-term strategy, and given the enhancement of Citi’s risk capabilities in this space, we at Citi Ventures are looking to invest in and partner with AI-driven wealthtech startups. Together, we hope to transform the way people manage and grow their wealth and support the development of a more accessible and equitable financial future.

For more information or to connect with our team, email Jelena Zec at jelena.zec@citi.com or Avi Arnon at avi.arnon@citi.com

For more insights into today’s hottest fintech trends, visit our Perspectives page.