How AI is Disrupting SMB Lending and Creating New Opportunities for FinTechs and Banks

By Jordane Giuly and Morgan Ohana, Defacto; and Luis Valdich, Maria Markusjan, Stephane Dumont and Patrick Brett, Citi Ventures/Citi SPRINT

Across industry and society alike, AI is transforming the way people communicate, create and do business. While consumer-facing generative AI (GenAI) chatbots like ChatGPT and DALL-E have earned the most public attention recently, AI is in fact delivering just as much — if not more — value behind the scenes.

Within financial services, AI is helping both large financial institutions and smaller fintech companies deliver best-in-class user experiences to new and underserved customer segments. From wealth management to AML/KYC screening, AI is improving automation, efficiency, personalization and more — driving the democratization of many financial products and services once restricted to certain client segments.

Meanwhile, small and mid-sized businesses (SMBs) around the world often struggle to manage their cash flow and maintain enough working capital to stay afloat. Per the US Chamber of Commerce, around half of all startups fail within their first five years and 82% of SMBs that fail do so because of cash flow problems. Given that SMBs account for nearly 70% of global jobs and GDP, ensuring that these companies have sufficient working capital is critical for the health of the global economy.

Unfortunately, that has historically been easier said than done — while many financial services firms offer working capital loans to SMBs, the traditional process of extending these loans has long excluded many of the companies that could most benefit from them.

That is due in large part to inefficient, manual processes that make underwriting each new client a significant investment of time and labor for lenders. For example, running a credit check on a new SMB client historically meant a loan agent opening a file, searching for the company’s details, verifying all the details they found then assessing the company’s credit risk. That could take up to an hour per file and could only be done on one file at a time — so the longer the queue, the longer the SMB would have to wait to find out if it got a loan. Since SMB loans tend to be relatively small, the return on the lender’s investment is often limited; as a result, even low-risk SMB customers often wait days or even weeks to find out about their business loans, only to be turned away or asked to pay high fees on their loans.

In recent years, however, AI has begun to shift this status quo by enabling innovative fintechs serving the SMB market to streamline their operations and more efficiently vet potential clients. New tools like Defacto (a Citi Ventures portfolio company) can run a credit check in as little as 27 seconds and can process as many files as needed at once, creating a smooth and user-friendly experience for SMBs with no operational burden. This yields much stronger unit economics, allowing fintech lenders to offer solutions to a large and underserved market while helping small companies access best-in-class lending services.

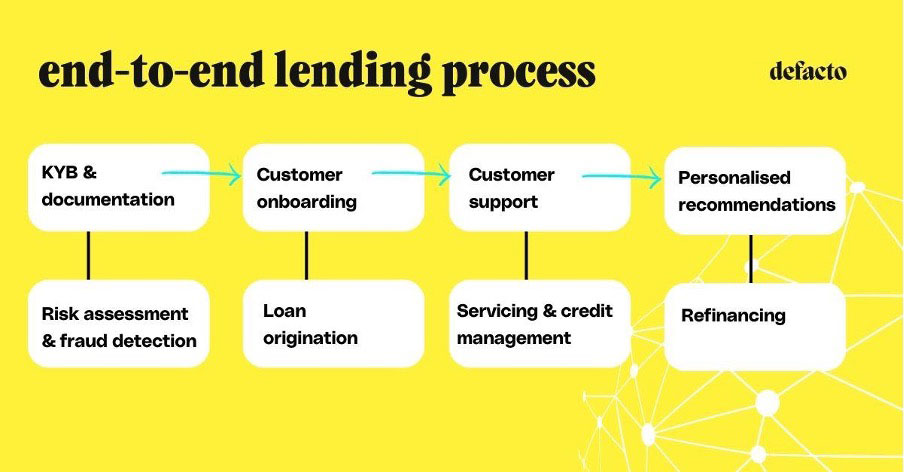

How Defacto leverages AI to make the lending process operationally lean from eligibility to collection

A system in which the operational costs outweigh the value is ripe for disruption, and fintech lenders like Defacto are well-positioned to do just that.

One of the leading embedded B2B lenders in Europe, Defacto manages the entire SMB lending value chain from customer acquisition to internal control — creating a seamless customer experience and allowing for operational optimization at every step. The company is also incorporating GenAI capabilities throughout its solution to improve the customer experience while keeping operational costs low.

Defacto’s current GenAI use cases include, but are not limited to:

- Creating highly personalised interactions with prospects and customers at scale via automated historical support summaries and resolution recommendations

- Automating administrative processes like updating international bank account numbers (IBANs), adjusting payment dates and sending contract signature links

- Improving fraud detection with document verification, risk profiling, real-time monitoring and behavioural analytics

- Providing custom refinancing recommendations by leveraging AI to analyse customer financial data, credit history and market trends.

To date, Defacto has directly lent half a billion euros to over 10,000 SMBs across Europe and offers its embedded lending infrastructure to a wide range of fintech partners and financial institutions, helping them more efficiently and effectively service small businesses.

Where banks come in

By leveraging AI and embedding their capabilities throughout the financial services ecosystem, digital lenders like Defacto are helping extend crucial working capital to more SMBs than ever before. In order to do so, however, they need to work with large financial institutions that can provide the capital itself. Meanwhile, banks have significant capital to deploy as loans but can find it challenging to leverage alternative data sets and AI to underwrite SMB loans.

That makes for a perfect match between banks and fintechs. By partnering with fintechs like Defacto that are using AI technology, banks can extend their loans into client sets and geographies they would otherwise struggle to reach. In return, the fintechs gain access to vast new tranches of capital, dramatically increasing the number and size of loans they can facilitate for SMBs — backed by the trust and stability of an incumbent financial institution. Due to banks’ generally lower cost of capital, fintechs can also make those loans available to SMBs at more attractive interest rates.

At Citi and Defacto, we have made just such a match: in 2023, Citi both invested in Defacto and provided it — alongside Viola Credit — with a securitization fund of up to €167 million that Defacto is now extending to European SMBs. We are proud of the positive impact that working capital is already having for SMBs and job creation across Europe, and are excited to see where the Citi-Defacto collaboration goes from here — accelerated by the power of AI.